At one point or another, we all wish for more time—more time to spend with family and friends, more time catch up on overdue work, or more time to simply enjoy what we love doing most. Well, next year, you do! 2020 year is a leap year—giving you one extra day to enjoy however you wish.

And while February 29th, 2020 may seem a long way off from today, those ancillary 24 hours may interfere with your billing process NOW unless you take proper action.

Don’t Let Your Billing Leap Out of Control

Depending on your billing schedule, leap day 2020 may soon cause a change to your billing calculations. If you bill based on the number of days in a year, the upcoming leap year will cause the actual number of days you bill jump by one to 366 days. Simply stated, because of this one extra day added to our calendars, you will bill your clients for one more day than you might intend to. If your firm charges annual, one-time financial planning fees, you may have already noticed the change in calculations. Firms that bill in advance, either semi-annually or quarterly, can also expect to be impacted soon.

How to Get Ahead of Your Leap Year Billing

Fortunately, ensuring that your billing stays on track during a leap year isn’t as complicated as calculating Earth’s actual revolutions around the sun (the reason why leap years exist, for those that wanted a refresher).

To update your billing so that your clients are not billed for an extra day in 2020, simply contact the Orion SME Billing team and say “update the leap year entity option to ignore the leap day”. That way, your clients will not be billed for an additional day of service.

Leap Year: The Perfect Time to Review Your Billing Methodology

And, what’s a billing blog without a little insight into billing best-practices? As an advisor, you have multiple options when it comes to calculating fees for your clients. You can choose to calculate feeds fees in arrears (bill for past months) or in advance (bill for future months). You can also select various valuation methods; the two most common methods are by Average Daily Balance (just like it sounds, bill on the average amount in an account over a period of time) or Period Ending (bill on the amount in an account on the last day of the quarter).

Check out our recent post where we’ll explain not only why billing in Arrears with Average Daily Balance is the best practice for most advisors but also highlight the core benefits of switching to this method and identify compliance and revenue considerations.

Ready to make sure your client accounts are ready for leap year billing? Click here to log into Orion Support and chat with our SME Billing Team.

0197-OAS-3/7/2019

3 Ways to Simplify Your Advisory Fee Billing ProcessAs RIAs look to set themselves apart from increasing competition, many firms are choosing to add new services as a way to both boost revenue and attract clients.

In one survey, 66% of advisors say they have a plan for adding a robo advisor to their firm. Other advisors are emphasizing services like financial planning, estate planning, or trusts, while some advisors are using tax planning to draw in new clients.

When an RIA adds a new service, the decision has to be made to roll that service into their existing AUM fee, or to offer it for a separate, standalone fee. In the case of standalone fees, the billing process is often managed through spreadsheets or an additional technology platform, and can sometimes become complex, timely, and costly as a result.

But it doesn’t have to be.

As part of our May software update, we released a simple solution to streamline billing for those firms that bill for single or recurring service fees separate from their AUM-based fees.

The new Financial Planning Fees billing feature, available now in the Bill Generator app, enables you to keep all billing data in one place; helps minimize compliance risks; and creates a simple and streamlined way for clients to pay you, regardless of fee type.

Let’s look at three ways Financial Planning Fees within Orion helps you simplify the process for managing financial planning fees.

1. Keep All Your Billing in One Place

When you work with Orion, there’s no need to add a separate billing application to handle your service based fees. And that also means you won’t have to re-enter the AUM-billing data that Orion stores for you into another system.

Keeping all fee billing information in one platform helps in three key ways:

- Eliminate the need for a separate financial planning billing application, process or system and help streamline those important workflows.

- Maintain and generate all your firm’s fees, whether recurring or one-time in a single location.

- Review all revenue-producing services at a firm level to ensure consistent cash flow today and uncover trends to help project future revenue sources.

2. Launch the Blue Pay Integration to Streamline Payment

When you integrate Orion with BluePay for electronic payment processing, you also add additional security measures to your billing process. Whether for a recurring service or single transaction, clients can pay fees directly by secure credit card or ACH transfer. The integration also enables an added security step of requiring a CAPTCHA before accepting a payment.

Electronic payment processing can help reduce the risk, costs, and time spent with manual payment processing, but it also helps in another way: The BluePay integration assists compliance with current billing and payment regulations by never requiring you to custody a client’s payment information.

3. Eliminate Client Confusion

The third way Orion can help simplify your billing process relates directly to your clients. Your clients already use your Orion Client Portal to access their important financial information, receive updates from you, so why not also use the Portal as a quick and convenient way for them to pay their financial planning fees?

After you set up your BluePay integration, you can enable a new secure billing page so clients can pay their fees directly through your Orion Client Portal. Get rid of paper waste and the cost of mailing invoices, and enhance security by automatically keeping all client payment information behind their secure Client Portal, instead of delivering it through other electronic means like email.

Here’s three other ways running all your bills through Orion can help make things easier on your clients.

- Your invoicing process can remain consistent. It can be confusing if clients have to pay you by different methods, but with Orion, you can standardize the way you’re paid and keep things simple for clients.

- You maintain consistent branding. An invoice a client sees for AUM-based fees looks the same as an invoice a client might receive for a planning fee when you handle all your billing needs in Orion.

- You can meet client expectations for how to pay for services by giving them the ability to pay their invoices online.

What Managing Planning Fees Looks Like in Orion

By making Financial Planning Fees a unique and separate part of the Bill Generator app, we’ve streamlined the fee billing process.

When you log into the Bill Generator app in Orion Connect, you’ll see a new section on the left navigation pane called “Finished Bills.” Click Planning Fees to access all your planning fees, and see them independently categorized from your AUM-based fees.

If you need to add a new fee, click Actions to begin the process and then follow the steps in the setup wizard. If you’ve ever created a fee schedule or created a bill in Orion before, this process should be familiar to you.

With the new Financial Planning Fees feature, you can create a simple and streamlined way for your firm—and clients—to manage all fees, all in one place. Log into Orion Connect today to try it out for yourself.

Want to learn more about financial planning billing in Orion Connect? Click here.

An integration with BluePay is required for some of the features discussed in this article.

0292-OAS-5/22/2018

Advisory Fee Billing Can Be Simple with Orion’s End-to-End Billing SolutionsConsumers are bombarded daily by messages boasting the latest and greatest – whether it’s something new, improved, cheaper or more efficient. Sometimes it’s difficult not to be pulled into a shiny new product. The financial technology industry is no different. New systems and products are constantly released with the idea that this new system can solve all your problems.

Companies will use marketing tricks and language such as “we are the first and only,” luring advisors to purchase or use their product. It’s disappointing to discover these new products often don’t meet the client’s needs, require additional time to maintain, or are simply overpriced.

Orion has continued to be the leading edge in technology when it comes to billing set-up, billing calculations, financial planning fees, process of fees, and the calculation of payouts. That’s why most of these new ideas already exist in the Orion platform.

When you choose new technology for your company, it’s in your best interest to learn about everything it can do so you can take full advantage of all it offers. If you don’t, then you may see a new solution that comes along offering to do something your current technology stack can already help you accomplish. And then you’ll end up in the unfortunate situation of paying for two systems, when you really only need one.

The Orion platform includes personalization and customization throughout, and today we want to look at the tools available to you in our advisory fee billing apps. The Orion advisory fee billing solutions offer your firm all the tools you need, including:

- Calculating fees, both for recurring and one-time payments

- Invoicing clients with personalized invoices

- Uploading fees to your custodians for seamless collection

- Accepting ACH and credit cards

- Tracking outstanding unpaid fees

Orion’s tools are an end-to-end solution, meaning you can do everything your firm needs—from billing setup to fee collection—with our apps.

Let’s take a look through the ways you can use Orion to support your team members, and also give your clients a better experience when deciding how to pay their advisory fees.

Simple Setup Tools

Orion offers a way for you to easily set up accounts so their billing information is correct from day one. If you use the New Account Center, you can designate fee schedules and payout schedules that you’ve created for each new account, all from a single screen.

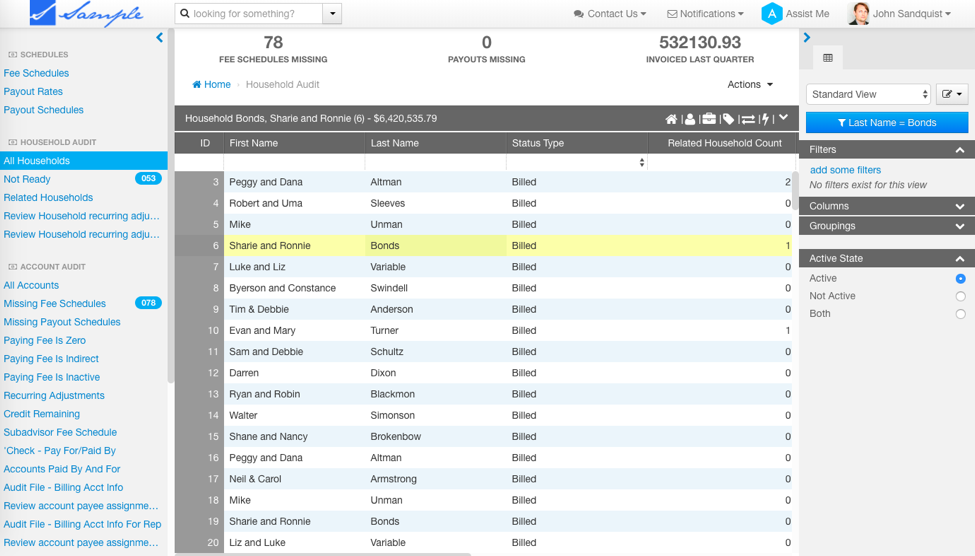

Instead of clicking from one account to the next, it’s all done at once. If your firm doesn’t use the New Account Center, we’ve built in other options to give you the same efficiency. Load up the Billing Audit app to view all the accounts in your database and check their billing information there instead. You can filter and sort by any criteria you want, like accounts without a fee schedule assigned, so you can be sure that your data is clean.

Calculating Fees and Invoicing

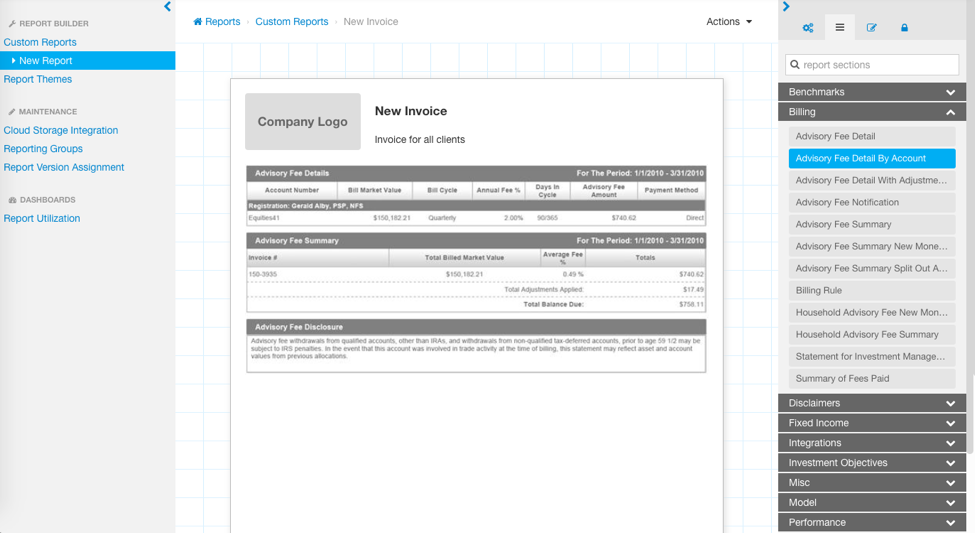

When it comes time to calculate fees, the Orion team has built a workflow with you in mind. You can use the Billing Generator app to create a Forecast Bill before quarter-end comes around to run a mock advisory fee calculation to get a sense of what you’ll be collecting.

Creating a live fee instance is just as simple. You’ll select the date range to calculate fees for, which clients need to be included, and the Orion system will calculate your fees based on the schedules and other information you’ve entered, like one-time adjustments or other criteria unique to each client. All your special billing rules and client-specific changes can be stored in Orion so the system can take them into account when calculating fees.

After calculation is done, you can choose from one of eleven invoice templates that you can further personalize with your firm’s branding. Print and send the invoices, or post them to your Client Portal. The choice is up to you.

And after invoicing is complete, Orion has streamlined your fee collection process by creating custodian-specific fee files. Whether you custody with TD Ameritrade, Schwab, or any other major custodian, the system is built to give you the file format you need, in a way that’s ready to upload.

The last step of invoicing is tracking who’s paid, and you can even track outstanding receivables in Orion as well.

From beginning to end, the Orion fee billing system’s tools can offer you the customization and scale your team needs to be more efficient during quarter-end.

Credit Card Processing

Everything we’ve covered so far is great for your internal team’s efficiency, but we also want to provide you with the tools to create a better experience for your clients.

If your clients want to pay their fees with ACH, credit card, or check, you can accept all these payment methods seamlessly in Orion.

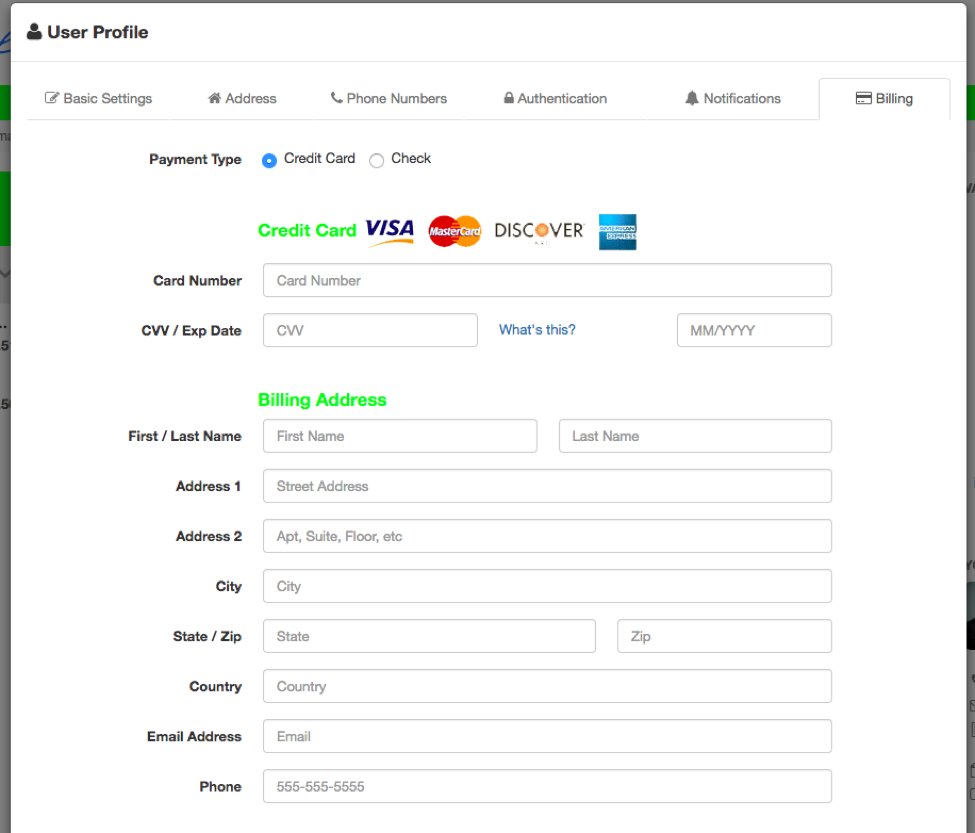

Through our integration with BluePay, your clients can enter their billing information in the Orion Client Portal once, and have their information saved and ready once fee collection time comes every time after that.

The billing information your clients enter through the Portal integration is stored with BluePay and not accessible by Orion users at your firm.

Once you’ve turned on the BluePay integration, all your clients need to do is head to their User Profile, click on Billing, and enter their information in your secure portal. [Note: If you need more information about BluePay, log into the Orion Integrations Center to learn more.]

The experience is user friendly, and simple to complete.

Seamless Advisory Fee Billing with Orion

Your team can streamline their everyday workflows by completing every step of your advisory fee billing process in the Orion Connect suite of billing apps. With Orion’s daily reconciliation practices, you can be confident that the data you’re using to bill is already clean and well-kept so you don’t have to worry if you’re billing on correct amounts.

Have any questions about the capabilities of the Orion billing apps? Get in touch with our SME Billing Team through Orion Social today.

0047-OAS-1/25/2018